|

|||||||||||||||

|

Name

Cash Bids

Market Data

News

Ag Commentary

Weather

Resources

|

Big Corn, Soybean Harvests Are Hanging Over Grain Futures Markets

Very large and possibly record-high U.S. corn (ZCZ25) and soybean (ZSX25) production totals this fall appear to be looming over the grain futures markets. After the Pro Farmer annual crop tour in late August revealed some disease that could slightly nip corn and soybean yields and provided corn and bean markets a boost, grain market traders are back to focusing on very high corn and soybean crop yields. An Allendale crop survey last week pegged the average U.S. corn yield at 187.5 bushels per acre and total U.S. corn production at 16.631 billion bushes. The survey put the average U.S. soybean yield at 53.3 bushels an acre and U.S. production at 4.268 billion. All of Allendale’s projections were very close to the latest USDA U.S. corn and soybean crop estimates. The USDA will update their corn and soybean production estimates this Friday near midday in its monthly supply and demand (WASDE) report.

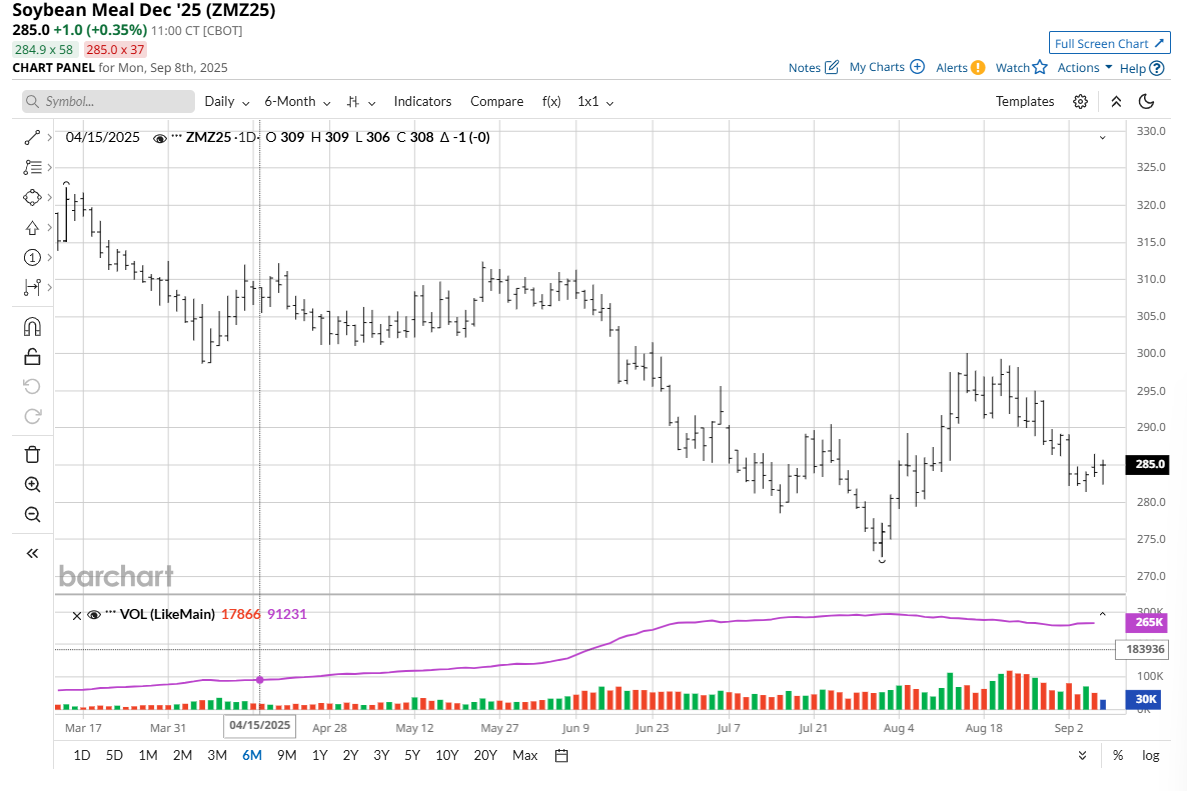

Corn and Soybean Meal May Hold the Key to Grain Prices Direction in the Near TermDecember soybean meal futures late last week dropped to a four-week low and are not far above the contract low set in late July. December corn futures hit a six-week high on Friday before backing off by the close. In my days as a markets reporter on the trading floor of the Chicago Board of Trade many moons ago, veteran grain traders would tell me that “corn is king.” They also told me that soybean meal (ZMZ25) is the key market to watch in the soybean futures complex. Indeed, it could be that the fate of the grain futures markets in the coming weeks hinges, at least in part, on whether corn prices are stronger than soybean meal. If corn is stronger, it could pull meal up, but if soybean meal prices are weaker, they could pull corn down. Whichever trend wins out, the grain markets could well follow that trend at least until U.S. corn and soybean harvests are in full swing.

Corn Remains ResilientDespite the mild profit-taking pressure into the close on Friday, the takeaway last week for the corn futures market is that the bulls continue to show resilience on price setbacks. That means a price uptrend on the daily chart remains alive, to keep the chart-based speculators wanting to continue to buy dips. However, U.S. corn harvest pressure and related commercial hedge selling will ramp up in the coming weeks, which could limit the upside in futures prices. Also bullish for corn, there is continued evidence of strong new-crop U.S. corn sales. The USDA reported old-crop U.S. corn export reductions of 280,900 metric tons (MT) for the week ended Aug. 28, a new marketing-year low, but were within the pre-report range of expectations. However, new-crop U.S. corn sales were reported at 2.12 million MT, which were near the upper end of the pre-report range of expectations. Soybean Bulls Are Fading FastNovember soybeans last week dropped 27 1/2 cents for the week. The soybean market bulls are struggling now, and prices are starting to trend down on the daily chart. Again, meal needs to start performing to the upside for soybeans to have a good chance to start to rally. Like corn, soybeans will have the price-bearish element of harvest pressure and the related commercial hedge selling picking up as September progresses, which will likely keep any price rallies modest at best. USDA Friday reported old-crop U.S. soybean export sales reductions of 23,800 MT for the week ended Aug. 28 but were within pre-report expectations. New-crop U.S. soybean sales of 818,500 MT were near the low end of the pre-report range of expectations. Traders will remain focused on China in the coming months as the top global soybean importer continues to stall on U.S. new-crop purchases. Winter Wheat Prices Languishing Near Contract LowsDecember soft red winter wheat (ZWZ25) futures Friday saw a contract low close and for the week were down 15 cents. December hard red winter wheat (KEZ25) on Friday set a new contract low and ended the week down 14 1/2 cents. The winter wheat futures markets continue to be mired in price downtrends, with new contract lows occurring nearly every week since mid-July. Technical selling will likely continue to be featured as long as the price downtrends remain firmly in place. Wheat futures bulls will very likely need the help of rallying corn and/or soybean markets to pull wheat prices out of their tailspins.

Tell me what you think. I really enjoy getting emails from my valued Barchart readers all over the world. Email me at jim@jimwyckoff.com. On the date of publication, Jim Wyckoff did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. |

|

|